Gratitude. Pass it on.

One morning in January, Briana woke up bright yellow,with a mysterious blood

disease that, even today, remains a mystery to her doctors at Children's

Hospital. As part of her illness, she needed transfusions, lots of

transfusions.And she was not able to go to class for two months.

"It was amazing," Jill said, "So many people from the Chaminade community

took time out of their day to drive an hour to the hospital to donate blood,

specifically to Briana. Everyone really came together, even people we did

not know at the time. They gave because we were part of the Chaminade

family."

The help did not stop there. There were offers to dog walk, to visit in the

hospital, to help with homework, to run errands for the family. Bro. Tom

Fahy, the Chaminade principal at the time, visited personally. Former head

of counseling Juliana Gallant and Briana's counselor, Jeffrey Fuller, worked

with Briana to ensure that she was able to succeed when she returned to

school.

Initially, they wanted her to home school, but Briana herself was eager to

come back. Mr. Fuller worked as her go-between with the

teachers,coordinating her workload and meeting with her three times a week

before school.

"His help allowed Briana to feel normal again, to be a high school student

again. By transitioning back into school, she was able not to let her

illness define her. It was important for her whole person to recover,to just

be a 16-year-old," Jill said.

"The school went above and beyond to help her finish school and get into a

great college. It did not let her fall through the cracks," she said."All

these people came together and made this easier for us. It was amazing. I

couldn't have done it without their support. You are not an island—you need

people, people who help you in your darkest time."

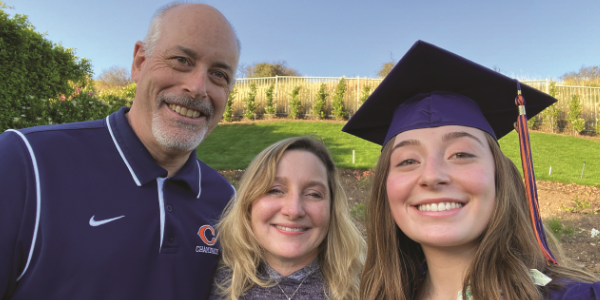

Two years after her illness, Briana turned 18 and subsequently graduated

from Chaminade with honors. The family was still active with her follow-up

care, but with all three kids now adults, it was time to review their wills.

They were so grateful for all the support that Chaminade had provided to

them that they decided that a planned gift was a good way to show their

gratitude. So they rewrote their wills to include a bequest to the school in

the future.

"It just made sense to us," said Jill. "When something like this happens,you

just feel so grateful."

Jill and Steve are now members of the Eagle Heritage Society, established by

Chaminade to recognize donors who have included the school in their estate

plans. Gifts such as the one made by the Ortiz family enable Chaminade to

continue to fulfill its mission well into the future.